Reinsurance renewal rates continued dropping during this year’s January renewals, but US property-catastrophe reinsurance pricing is likely to stabilize during the coming midyear renewals, according to a report from Moody’s Ratings.

“The upcoming midyear 2025 reinsurance renewals, which focus on the US, will be influenced by large US catastrophe loss events over the past year – particularly Hurricanes Helene and Milton and the Los Angeles wildfires – which are likely to provide support to reinsurance pricing for US exposures,” said the Moody’s report, titled “January renewal prices dip, but US catastrophe events could slow decline,” which was published on March 13.

As a result, Moody’s believes it is likely that US property catastrophe reinsurance pricing will stabilize, “supported by the potential for significant price increases for accounts that have had sizable losses over the past year.”

At the January 1, 2025 renewals, there were moderate risk-adjusted pricing decreases for property coverage, said Moody’s, noting, however, that prices depended on the geographic region and whether accounts were hit by losses last year.

Despite significant global insured catastrophe losses over the past several years, “reinsurers have reported strong results as higher attachment points for property catastrophe reinsurance improved underwriting results for reinsurers and boosted capital across the sector,” which meant there was sufficient reinsurance capacity to meet demand, Moody’s said.

January Reinsurance Renewals

Typically, between 40% and 60% of a global reinsurer’s portfolio is renewed on January 1, including a substantial majority of European business, Moody’s continued.

“Several European-based global reinsurers reported premium growth for reinsurance business renewed 1 January, as firms sought to deploy capital in a still-attractive pricing environment. Gross premiums written increased at Swiss Re (7.0%), SCOR (9.6%) and Hannover Re (7.6%), while Munich Re’s premium volume was down 2.4% because of underwriting actions intended to reduce business not meeting its return hurdles.”

Pricing across the portfolios of these European reinsurers was generally flat, ranging from a 2.1% decrease, reported by Hannover Re, to a 2.8% overall increase, reported by Swiss Re, Moody’s said. “For its nonproportional business, SCOR reported the first pricing decrease (-0.8%) since the January 2017 renewals.”

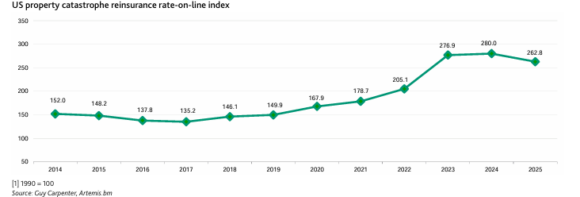

For the key US property catastrophe reinsurance segment, reinsurance broker Guy Carpenter reported overall pricing decreased by 6.2% at the January renewals, which was the first decrease since the January 2017 renewal period that marked the end of the soft market for reinsurance.

“Generally, pricing was largely stable in working layers – the lower levels of reinsurance used for more frequent and smaller claims. However, pricing was lower at the top end of reinsurance programs where there was plenty of capacity available for coverage of less frequent and larger claims, for which pricing remains attractive on a risk-adjusted basis.”

Casualty Business

Beyond property coverages, Moody’s said, pricing for casualty business was mixed and largely dependent on the performance of individual treaties.

European casualty was flat to down 10% for loss-free accounts and flat to up 10% for loss-impacted accounts, said Moody’s quoting reinsurance broker Gallagher Re. “In the US, general liability was down 5% to up 5% for loss-free accounts and flat to up 10% for loss-impacted accounts.”

The report noted that ceding commissions were broadly stable at the January renewals “as reinsurers held the line on payments to ceding companies given the increase in loss-cost trends due social inflation in recent years.”

Source: Moody’s Ratings

Photograph: In this satellite image provided by CSU/CIRA & NOAA taken 1:10 GMT on Feb. 25, 2025, shows three cyclones, from left, Alfred, Seru and Rae east of Australia in the South Pacific. (CSU/CIRA & NOAA via AP, File)

Related:

Topics

Catastrophe

USA

Reinsurance

Property

Interested in Catastrophe?

Get automatic alerts for this topic.